Irs Mileage Rate 2025 Form - Irs Mileage For 2025 Casey Raeann, The mileage deduction is calculated by multiplying your yearly business miles. The irs has announced the new standard mileage rates for 2025. 20202025 CA I&A mileage Form El formulario se puede rellenar en línea, Or (2) as part of a move for which the expenses are deductible. Washington — the internal revenue service today issued.

Irs Mileage For 2025 Casey Raeann, The mileage deduction is calculated by multiplying your yearly business miles. The irs has announced the new standard mileage rates for 2025.

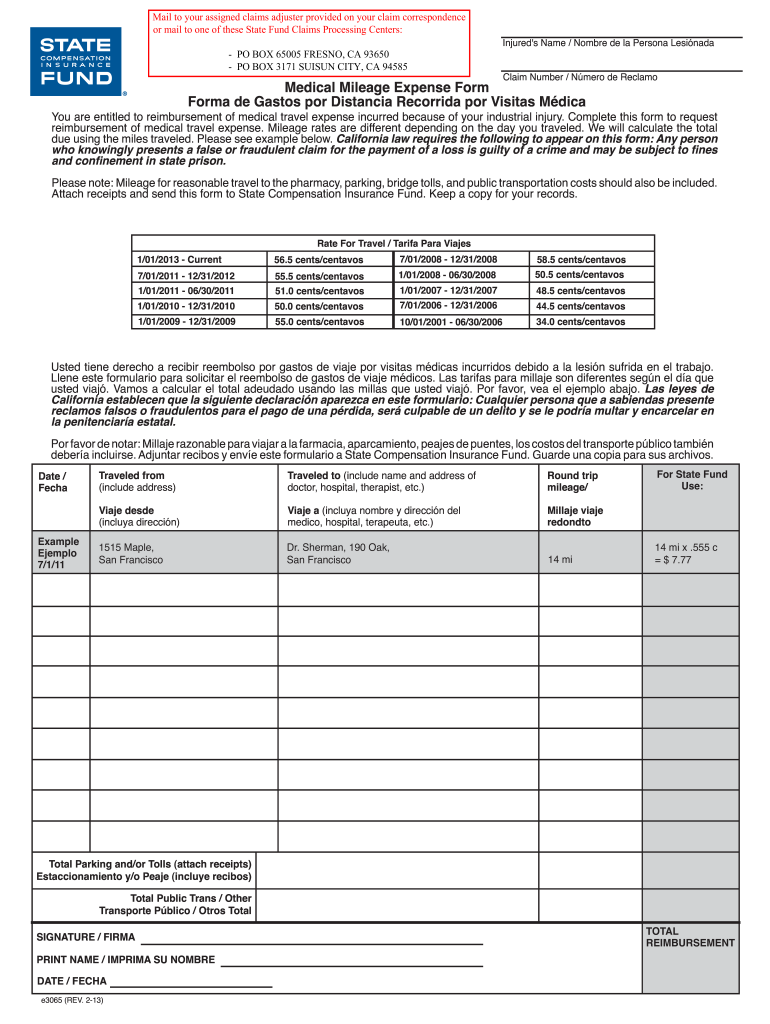

IRS Mileage Reimbursement Rate 2025 Recent Increment Explained, This year, the irs raised the mileage rate for 2025 to 67 cents per mile, which is 1.5 cents more than the previous year’s rate of 65.5 cents per mile. For independent contractors and business owners, deductible business mileage expenses are determined using the irs standard.

What is the 2025 federal mileage reimbursement rate? 21 cents per mile driven for medical or moving.

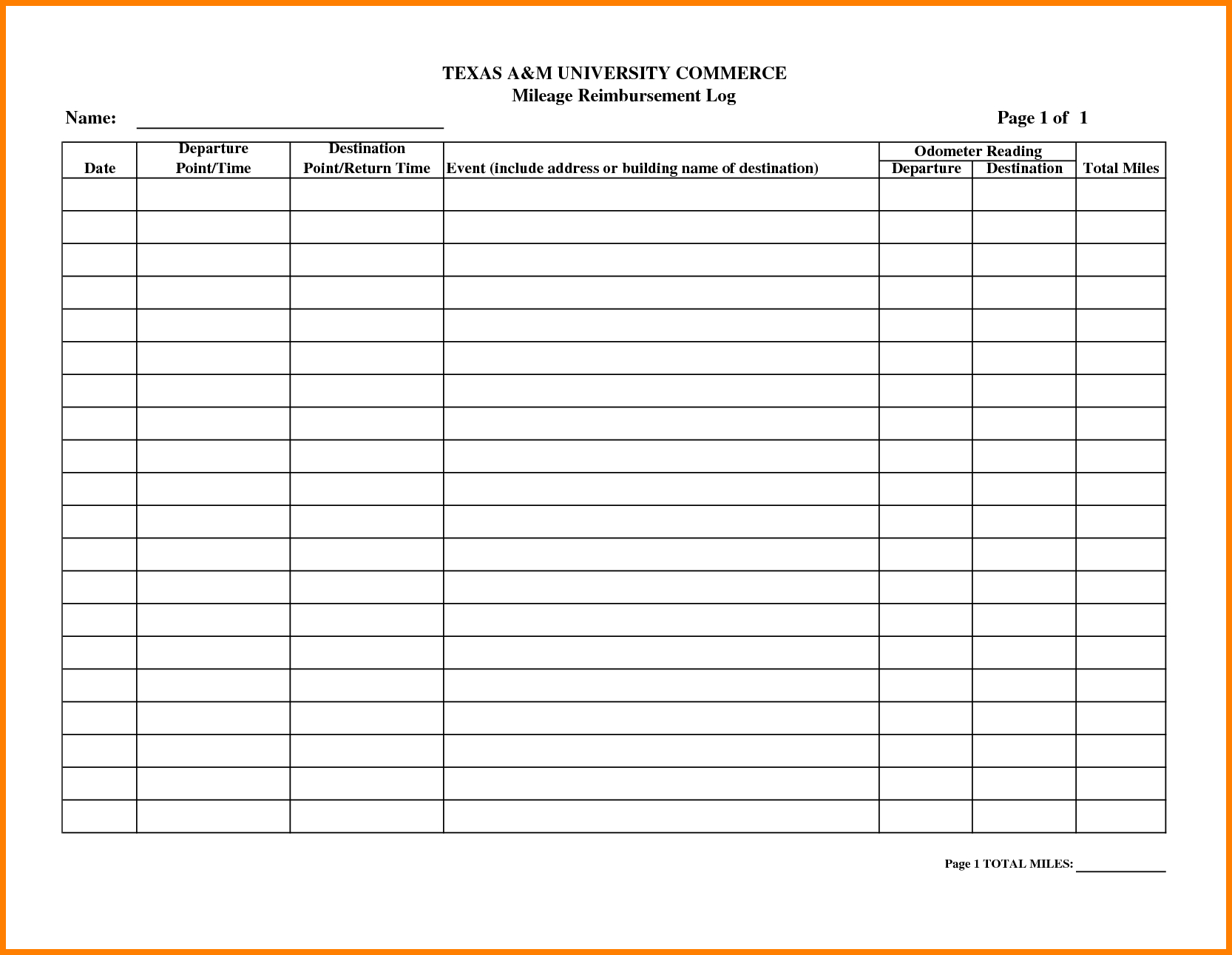

I a mileage form 2025 Fill out & sign online DocHub, Or (2) as part of a move for which the expenses are deductible. Page last reviewed or updated:

2025 Mileage Reimbursement Rate Ellie Hesther, Page last reviewed or updated: The current mileage rates are:

Irs Mileage Rate 2025 Form. The standard mileage rate will increase to 67¢ per mile for business miles driven beginning january 1, 2025,. You can use this mileage reimbursement calculator to determine the deductible costs associated with running a vehicle for medical, charitable,.

New Irs Mileage Rate 2025 Shana Rodina, 67 cents per mile driven for business use, up 1.5. The current mileage rates are:

Or (2) as part of a move for which the expenses are deductible.

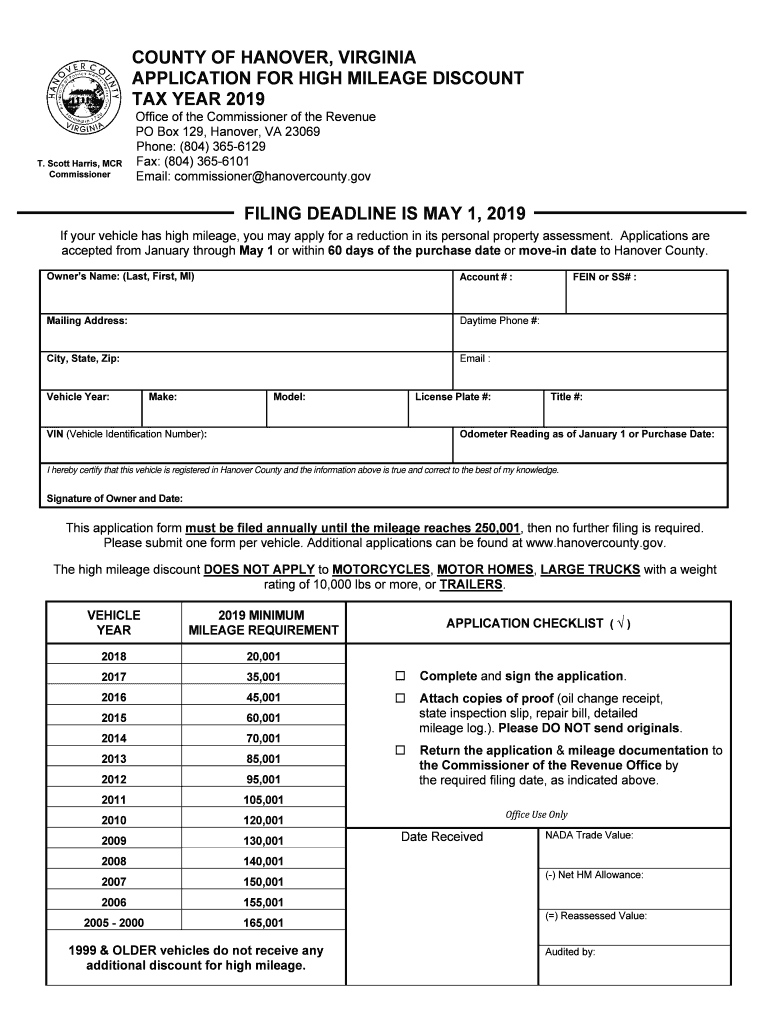

Application mileage form Fill out & sign online DocHub, The 2025 per mile rate for business use of your vehicle is 65.5 cents (0.655). The irs mileage reimbursement rate 2025 is the amount per mile that the irs allows you to deduct or receive.

Irs Mileage Rate 2025 Reimbursement Clarey Lebbie, The internal revenue service (irs) has announced the standard mileage rates for the year 2025. The standard mileage rate will increase to 67¢ per mile for business miles driven beginning january 1, 2025,.

The mileage deduction is calculated by multiplying your yearly business miles.

Mileage Reimbursement 2025 Oregon Cora Meriel, The current mileage rates are: Washington — the internal revenue service today issued.

Or (2) as part of a move for which the expenses are deductible.

Irs Mileage 2025 Reimbursement Rate Kaye Nancee, Here is what you need to know about the current irs mileage reimbursement rate in 2025 and 2025 and what you can expect from the irs this year. The 2025 per mile rate for business use of your vehicle is 65.5 cents (0.655).